Credit card theft cases have been on the rise so much that it’s now the number one type of identity theft frauds.

If you’re going to pay for anything online using your credit card, you have to protect your information now more than ever.

Instead of using your real credit cards, Privacy.com allows you to create virtual cards for different online payments. In fact, you can close cards that you create at any time and also create single-use cards that will close automatically.

Nevertheless, not everyone would opt for Privacy.com due to one reason or the other. If you’re in that category, I will show you the 10 best Privacy.com alternatives.

Best Privacy.com Alternatives

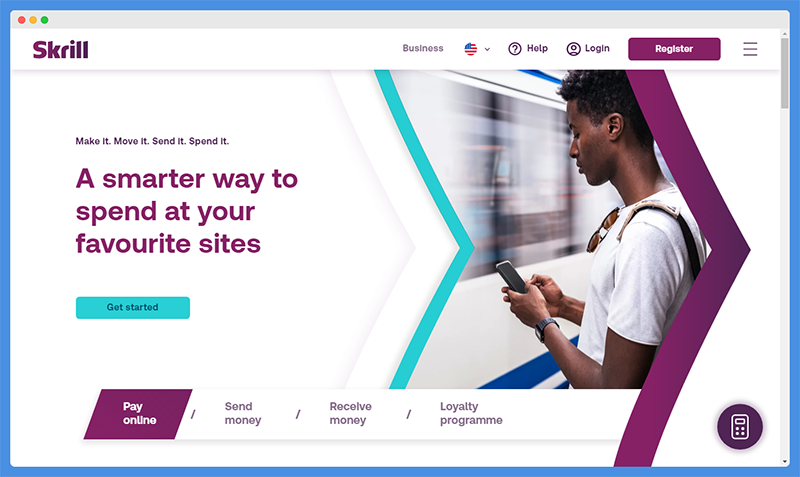

1. Skrill

Skrill offers payment solutions to individuals and businesses. With a Skrill account, you can create virtual cards for online payments.

Also, you can send and receive money from other Skrill users like I do. To use Skrill, ID verification is required.

As one of the best Privacy.com alternatives, Skrill allows you to create a virtual prepaid MasterCard for making quick online purchases using the funds in your Skrill account. Applying for a card is easy as everything is done online.

Just like Privacy.com, Skrill features mobile apps for Android and iOS devices. However, unlike Privacy that is limited to just US customers, Skrill accepts users from countries that are members of the European Economic Area and more.

Additionally, Privacy natively supports just USD. All transactions made in other currencies will be automatically converted to the US while Skrill supports USD, GBP, EUR, and PLN.

Furthermore, Skrill is a very secure platform to use. Your account is protected with a password and PIN in accordance with the Strong Customer Authentication regulatory requirement.

Apart from issuing virtual prepaid cards, Skrill also issues physical prepaid cards. Like the virtual cards, these cards are linked to your Skrill account and once you apply, it’ll be sent to your registered address.

As a Skrill customer, you can get support from their help page, which contains articles and answers to FAQs.

Skrill Pricing

Skrill is free for individual use. All you have to do is log in and make a transaction at least once a year. Otherwise, you’ll be charged $5 per month if there’s money in your account.

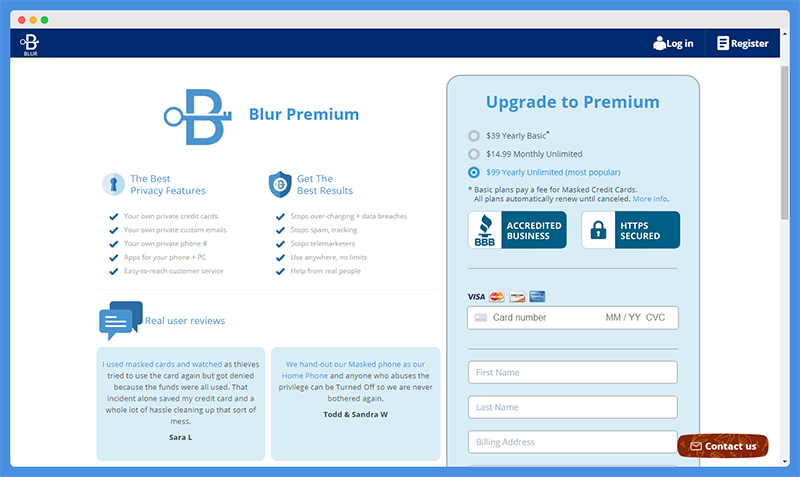

2. Abine Blur

Here is another dependable Privacy.com alternative on our list.

Blur by Abine is an all-round online privacy solution. Abine is also the company behind DeleteMe.

More than 30.5 million users currently use the Abine Blur privacy solution and it is used to protect online payments, passwords, emails, etc. In fact, they protect online payments with their ‘masked cards.’

These masked cards are virtual, just like the ones you get from Privacy. You can create a masked card for different purchases and the advantage here is that you can set specific spend limits for each card.

However, Abine Blur masked cards can only be created and used by residents in the United States; the same goes for Privacy.com. Consequently, as a US-only virtual card service, the platform also supports only the USD.

Also, these masked cards mainly work for purchases from US merchants, payment is blocked for most non-US merchants due to fraud.

Nevertheless, Blur stores and protects your credit card information locally. For more security, you can authorize Backup and Synchronization.

This will secure your information stored on their cloud servers in an encrypted form. 2FA is also supported.

There’s a detailed help FAQ page where you can get support. Also, there’s a specific FAQ section for masked cards and a Blur User Manual. Blur has mobile apps as well.

Abine Blur Pricing

There are both free and paid Blur versions and if you want to create your private credit cards, you must select the premium plan.

Check their pricing plans below:

- Basic Plan – $39 per year

- Monthly Plan – $14.99 per month

- Yearly Plan – $99 per year

The difference between their Basic Plan from the Monthly and Yearly Plans is that you pay a fee for your credit cards ($2 per card).

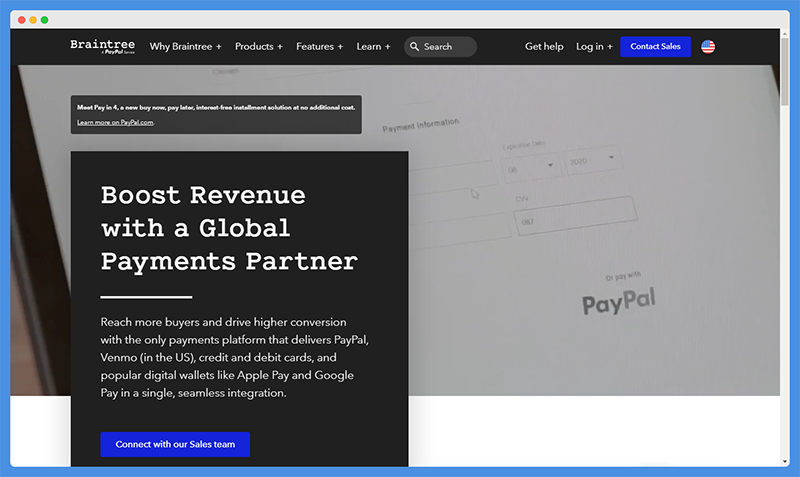

3. Braintree

Braintree is an ideal Privacy alternative for online businesses and merchants. It allows you to receive payment from your customers while protecting their payment information from fraud and breach. It’s a relatively advanced online payment processing solution.

Interestingly, Braintree supports a variety of payment solutions and providers. This includes Apple Pay, Venmo, PayPal, Samsung Pay, etc.

Also, it supports credit cards such as Discover, Maestro, American Express, VISA, MasterCard, etc.

What this implies is that with Braintree, your customers can pay you from any of these channels without worrying about their payment information being stolen. They won’t need to mask their cards as there are varying anti-fraud protection tools in place.

Likewise, Braintree supports more countries than Privacy.com that supports only the US. Supported countries include the United States, Canada, Malaysia, New Zealand, Australia, European countries, Singapore, and China. Also, you can receive payment in almost any world currency.

In total, Braintree supports about 130 currencies and you can set up your account to receive a single currency or multi-currency.

Security isn’t what you should worry about as a Braintree user. Their platform is Level 1 PCI compliant and recognized by Visa as a Global Complaint Provider. Card information like validation codes and PINs are not stored.

Furthermore, Braintree has a more reliable support medium than Privacy.com. You also gain access to their useful resources and FAQ page. The support team can be contacted via phone or by submitting a contact form.

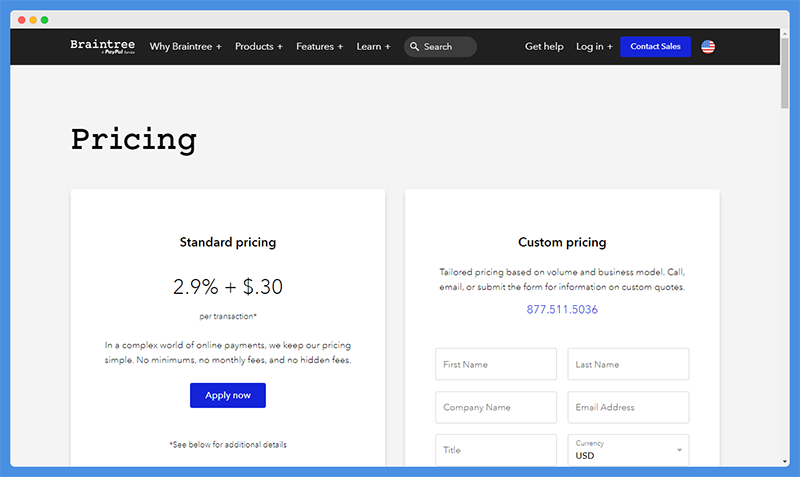

Braintree Pricing

To use Braintree, you must pay a premium. As mentioned earlier, it’s an advanced solution and not like Privacy.com that you can use for free.

Here are its two premium plans:

- Standard Plan – $0.30 + 2.9% per transaction

- Custom Plan – Custom pricing

4. Bento

Bento for Business provides everything you need to do business online as an individual or business. It is a debit card-based business spending management platform and like Privacy.com, it allows users to create virtual cards to protect their real card details.

To get a virtual card from Bento, you have to create an account and link your bank account. Then fund your account and request a virtual card. Bento virtual cards are VISA cards so you can use them online anywhere VISA is accepted.

You can create virtual cards for one-time-only use or multiple uses. Furthermore, you can create cards for specific payments and set spending limits.

Just like Privacy.com, virtual cards created with Bento can be used for US-only transactions. However, you have the flexibility to turn off this restriction and use your card for international payments.

Default restrictions are placed on several businesses to prevent fraud. This includes unlicensed businesses, shell banks, unregistered hedge funds, etc.

To further protect your privacy, Bento encrypts your data using 56-bit Secure Socket Layer (SSL) encryption. In addition, the platform is PCI DSS compliant.

You can get in touch with the Bento Support team for help using LiveChat or by phone call. Also, you can send your inquiries by email or from the on-site contact form. A support center is featured with helpful articles on getting started, using your account, pricing, and more.

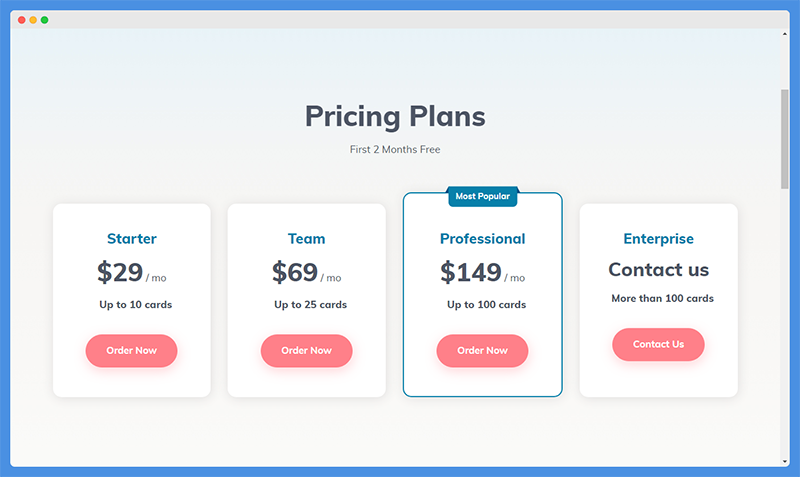

Bento Pricing

As a new Bento user, you get two months of free access. After that, you can choose any of the following pricing plans:

- Starter Plan – $29 per month

- Team Plan – $69 per month

- Professional Plan – $149 per month

- Enterprise Plan – Custom pricing

5. Neteller

Neteller is a popular online payment gateway. It enables you to pay for anything online securely. Also, like most of the privacy.com alternatives, it allows you to transfer money to other Neteller users anywhere in the world.

Neteller requires verification before you can request for and use its virtual cards.

The virtual cards issued by Neteller are MasterCards. While creating them, you’ll only be prompted to choose a currency, enter a card name, and set an optional limit.

However, if you’re a resident of France, a default 1000 EUR limit per month is applied.

While Privacy.com is open to only users who reside in the United States, Neteller is open to users who reside in European Economic Area countries.

Furthermore, the platform supports three currencies: GBP, EUR, and USD as against Privacy.com that supports only the USD.

Neteller is a secure Privacy.com alternative that features anti-fraud tools for 24/7 watch. As a PCI DSS compliant platform, all transactions you make using Neteller virtual cards are 100 percent indemnified.

They are also encrypted using 256-bit encryption and multiple firewalls.

Neteller offers support via different channels. First of all, there’s a support center with help articles on 4 major categories which include Account, Payments, Security, and Prepaid Cards.

Then, there’s an FAQ page and you can contact the sales team by sending a contact form.

Like Privacy.com, Neteller features Android and iOS mobile apps, so you conveniently manage your virtual cards from your mobile phone.

Neteller Pricing

Your first Neteller virtual card is issued for free. Subsequent virtual cards that you create will attract a fee of $3.

When setting up your card, you’re asked to select a default currency. If you use the card for transactions involving a different currency than the default currency, you get charged a 3.99% currency exchange fee.

6. Payoneer

Payoneer is a platform that lets you pay and get paid by anyone from different parts of the world. It is a platform trusted by some top renowned eCommerce, freelancing, and digital marketing platforms.

Like Privacy.com, Payoneer lets you make smarter payments using an e-wallet and card.

You can request a physical or virtual card for your Payoneer account. Payments made using this card are deducted from your Payoneer balance.

To be eligible to request a virtual card, your account must have received a minimum payment of $100 in the last 6 months.

Payoneer doesn’t support only US residents and the USD currency like Privacy.com. The platform supports USD, GBP, and EUR for virtual cards but you can transact in different currencies. Furthermore, as a global payment solution, Payoneer is available in over 150 countries.

What’s more? It is regulated by multiple government bodies which implies that your funds are safe. Transactions you make are guarded with firewalls and monitored to prevent fraud, phishing, etc.

As a Payoneer user, you are provided with all the support you’ll need. From the resource center and support center, you can find help articles and there’s a community of over 2 million Payoneer users where you can get answers.

You can also watch the Payoneer tutorial videos.

You can download and use the Payoneer mobile application for easy management on Android and iOS devices.

Payoneer Pricing

There are no subscription or start-up fees charged with using Payoneer. Also, no fee is charged when you use the virtual card to pay for things online.

However, there are several fees applicable to currency conversions. This applies when you pay for a different currency apart from your card currency and the charge is up to 3.5 percent.

7. US Unlocked

Like its name implies, this is a solution for US-only merchants which makes it more like Privacy.com.

Nevertheless, while you can only pay US merchants, you can make the payment from anywhere and you’ll be given a US billing address. Over 100,000 users make use of US Unlocked.

With US Unlocked, you can create exclusive virtual cards for different US merchants such as Amazon, Netflix, Hulu, Walmart, Spotify, etc. In total, US Unlocked features more than 500 US-based merchants. Also, each card can hold a maximum balance of $3,500.

All you need to do to create one is to apply and pay the membership fee and you’re good to go. In addition to creating exclusive virtual cards, you can also create one-time use cards.

Since only US merchants are supported, all payments you make using US Unlocked virtual cards are processed in USD just like Privacy.com.

Nevertheless, US Unlocked is not available to US users only; hence, you can pay from any country.

US Unlocked features personalized LiveChat support called Ruby. Likewise, you can submit a contact form to reach their support team. Other support channels include the resource center, FAQ page, and blog.

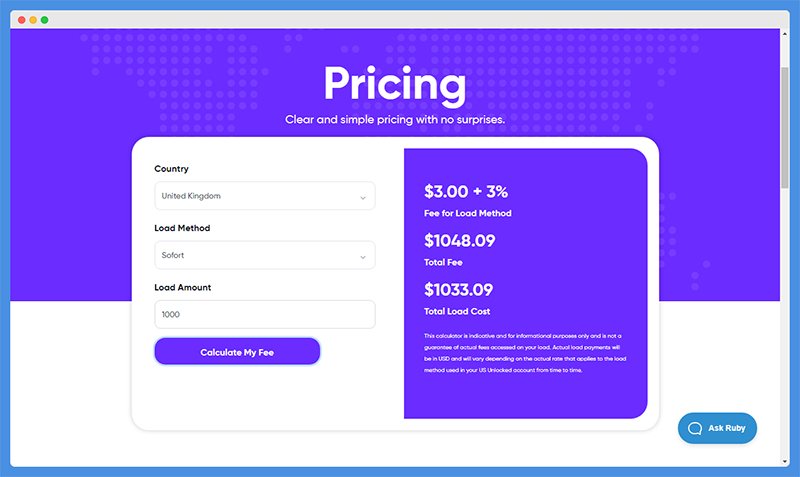

US Unlocked Pricing

This platform has a flexible pricing plan. The amount you pay for your card depends on your country, loading method (deposit method), and amount.

Aside from that, a $3.50 maintenance fee is charged per month and you’ll pay $11.50 for unloading.

You are also required to pay a life membership fee of $15. All of this makes Privacy.com more affordable than US Unlocked.

8. Netspend

Netspend issues prepaid Visa and MasterCard cards. It is a popular payment solution used by more than 10 million customers.

Just like most Privacy.com alternatives mentioned, Netspend requires ID verification before you can apply for and create virtual cards.

From your Netspend account center, you can generate virtual card numbers for temporary or recurring purchases.

You can create and manage up to 6 virtual cards at a time and you have the flexibility of customizing the card using your picture.

With Netspend, you can make purchases to merchants in multiple countries, unlike Privacy.com that is limited to the USA.

Due to their partnership with PayPal and Western Union, you can make purchases in over 200 countries with your Netspend card.

Netspend protects its users in two ways; online security and privacy policies. Your card details, ID, and other personal details are encrypted.

If you suspect any fraudulent activity with your account or card, you can report it and immediate action will be carried out.

For support, you can make use of the FAQ page or reach the team via email or phone. It’ll be easier to manage your Netspend account and virtual cards from the mobile app.

Netspend Pricing

You can use Netspend to create virtual cards free of charge; no activation fee is required. However, you’ll be charged usage fees depending on your plan. Here are their two pricing plans:

- Monthly Plan – $5 per month

- Pay as you go Plan – Custom cost depending on usage

With their monthly plan, you pay per month and are not charged for any transaction fees. Conversely, with the Pay as you go plan, you are billed for each transaction.

9. Brex

Another best Privacy.com alternative on our list is Brex.

Brex is tagged “the financial OS for the next generation of business”.

It’s an all in one platform where you can manage all your online payment activities including credit cards, bank accounts, expenses, etc. Brex is relatively more advanced than Privacy.com and although it is not a bank, it works like one.

When you create a Brex account, you are issued an account number, routing number, and virtual card details.

The cards are issued as soon as you are approved. You can generate many virtual cards that you need, set different spend limits for each one, and close them at any time.

Brex virtual cards can be used online anywhere the MasterCard is accepted. It is not restricted to a specific country like Privacy.com. This also implies that you can use its virtual cards to make payments in different currencies.

While 1Password is the only major integration featured by Privacy.com, Brex integrates with Xero, Oracle, QuickBooks, Xoom, Slack, intercom, DropBox, Carta, etc.

Brex secures your payment information through their PCI DSS-certified partners. With data modeling, you alone have access to your account, even the Brex team cannot.

Furthermore, the platform is HTTPS encrypted and Idle Lockouts is implemented such that your account is automatically logged out after inactivity.

If you want help, reach their support team using the contact form or access their help center and FAQ Page. Finally, Brex features iOS and Android apps for on-the-go usage.

Brex Pricing

If you are looking for a Privacy.com alternative to save money on pricing, you should consider Brex. Brex attracts zero fees, whether you are making local or foreign transactions with your card, and their cards are interest-free.

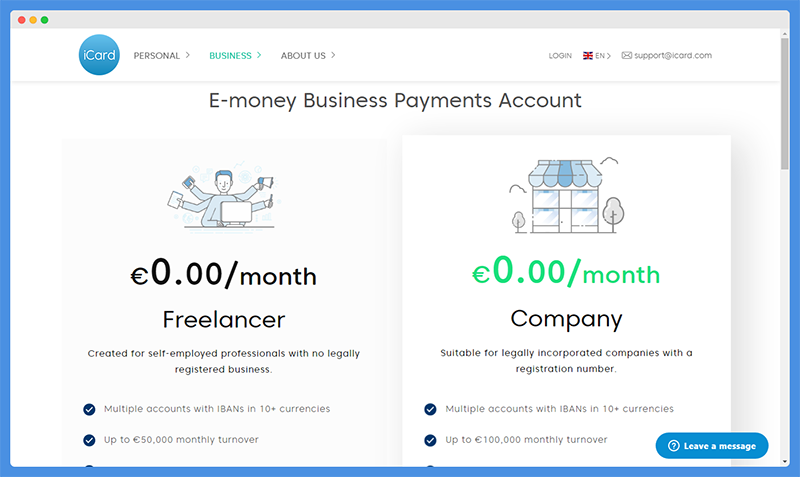

10. iCard

iCard is all about payment cards including virtual cards, physical cards, metal cards, etc. The platform also facilitates payment using digital wallets such as Apple Pay. iCard lets you manage both VISA and MasterCard virtual cards.

Immediately you create your iCard account, you can create these cards, load them, and begin making online purchases. You can freeze and unfreeze the cards at any time, set spending limits, and custom design them.

Furthermore, you can limit the cards to specific merchants like Amazon, AliExpress, eBay, Netflix, PayPal, etc.

iCard virtual cards are available to residents in Europe only, unlike Privacy.com that is available to residents in the US only.

However, with iCard, you can make payments in different currencies including the Romanian Lei, Euro, Polish Zloty, British Pounds, Czech Krona, US Dollars, Bulgarian Lev, Croatian Kuna, and Swiss Francs.

Apart from being a PCI DSS approved platform and regulated by the EU, you can count on iCard’s security measures. Besides, they encrypt your data using military-grade encryption protocols.

iCard features an FAQ page with tutorial videos if you need support. Also, you can get direct support using the LiveChat, contact form, or by sending an email or calling the helpline.

iCard Pricing

Whether you use iCard for personal or business purposes, the platform is free. As a new user, you are issued two virtual cards for free, a VISA and a MasterCard.

New virtual cards will cost just 1 EUR and you can manage up to 20 at a time. Likewise, no transaction or monthly management fee is charged.

Rounding Up – What Is The Best Privacy.com Alternative?

In this post, I have listed out the 10 best Privacy.com alternatives that also facilitate secure payments – not just for individuals but also merchants and businesses.

However, the best Privacy.com alternative is Skrill that has over 35 million users. Besides, Skrill can generate both physical and virtual credit cards.

Also, you can send or receive funds from other Skrill users. While Privacy.com supports only the USD, Skrill supports currencies like PLN, EUR, USD, and GBP.

Tom loves to write on technology, e-commerce & internet marketing.

Tom has been a full-time internet marketer for two decades now, earning millions of dollars while living life on his own terms. Along the way, he’s also coached thousands of other people to success.